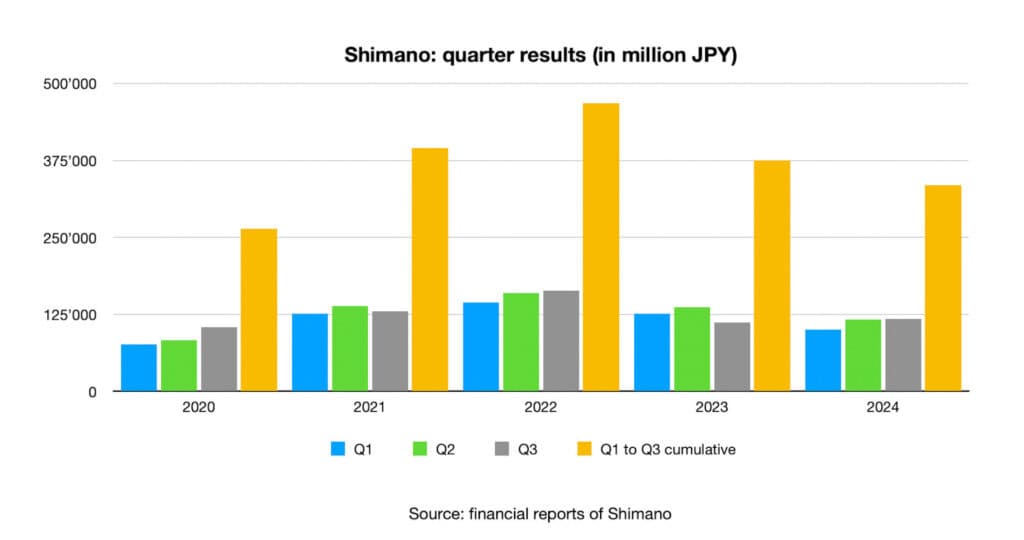

Component giant Shimano and suspension specialist Fox Factory, two key suppliers have released Q3 results. showing year-on-year growth for the first time after a series of quarters with contracting turnover.

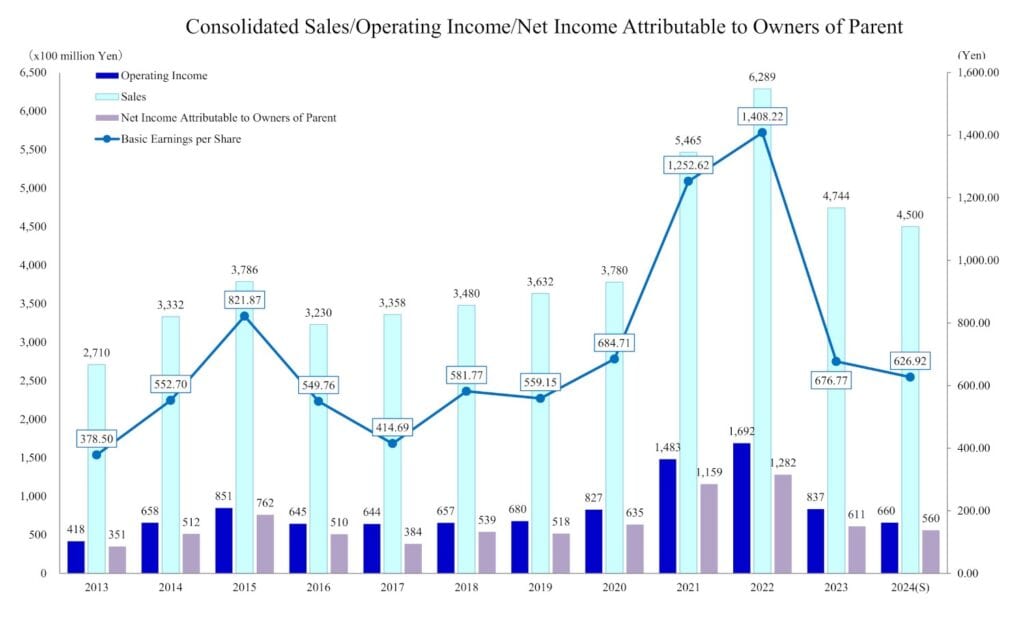

Shimano’s results in recent years mirror the entire market: following a stellar 2022 when turnover reached a record JPY 628.9 billion (US$ 4.14 billion), demand dropped drastically and brands canceled orders for hundreds of thousands of bikes, Shimano’s turnover dropped by almost 30 percent to JPY 474.4 billion (US$ 3.12 billion) in 2023. This negative trend continued into 2024 as the first quarter saw a year-on-year decline in turnover by 22 percent with the second quarter seeing another decline of 18.9 percent. Halfway into 2024, turnover was down by 20.7 percent.

Fast forward another three months and the decline in turnover has been reduced to minus 12 percent YOY for the period from January to September – a headline pretty much all b2b magazines chose to run with. But a closer look into the financial results as recently presented by Shimano shows that the third quarter actually saw a 5.34 percent increase in turnover year-on-year to JPY 118 billion (US$ 780 million). This marks the first quarter since the end of 2022 that its turnover did not decline year-on-year. For the full year, Shimano’s management stuck to the prediction it had revised back in July, expecting turnover to end up at approximately JPY 450 billion (U$ 2.96 billion). However, due to unfavorable currency exchange rates and the weak Yen Shimano decided to reduce profit expectations. See below for Shimano’s financial reporting going back to 2013.

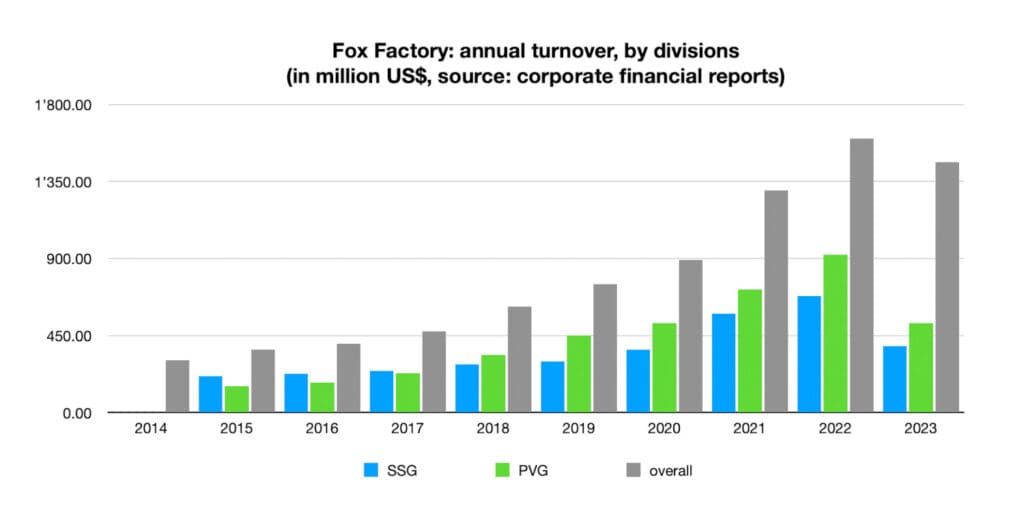

With brands such as Fox, Marzocchi, Race Face and Easton operating as its Specialty Sports Group (SSG), Fox Factory has its main bicycle-related business in the offroad segment. As a consequence, its turnover plunged by 40 percent in 2023 year-on-year, and things did not look any better during the first two quarters of 2024. Halfway into the year turnover for the bicycle division still was down by 39.3 percent or US$ 87.9 million year on year, hinting at a slower recovery than seen with Shimano. But since Fox Factory’s SSG division had still posted decent results in the first half of 2023 and only saw a sharp decline in turnover from there, the trend was likely to turn in Q3, a senior member of Fox Factory’s management explained to the Show Daily at Taichung Bike Week in late September.

As the numbers for Q3 show, the tide seems to be turning. While both the Aftermarket Applications Group and the Powered Vehicles Group posted weaker results year-on-year, things were different with the Specialty Sports Group: its turnover grew from US$ 72 million in Q3 2023 to US$ 149.5 million in Q3 2024. Not all of this growth was organic however. Almost US$ 50 million resulted from the acquisition of baseball specialist Marucci. Still the bicycle segment’s turnover grew by US$ 27.9 million or more than 38 percent year on year, marking an end of a series of quarters with drastic declines in turnover. It remains to be seen if this good news from two key suppliers is an early indicator of a recovery in global bicycle markets.