The bicycle industry has experienced a turbulent journey over the past few years. According to a recent study by investment specialists from Houlihan Lokey and Kearney, the industry is now poised for recovery, with a potential resurgence in mergers and acquisitions (M&A) as early as 2026.

There are numerous metrics that describe the status of an industry. In the bicycle industry, import and export data from various countries and regions are omnipresent. Various publicly listed bicycle companies regularly release their business reports and production data from factories provides insight into the state of supply and demand. Another key indicator is the activity in the mergers and acquisitions landscape.

This is underscored by a recent study published by Houlihan Lokey Inc., a top global investment bank, and Kearney, a leading global management consultancy, which analysed the M&A landscape in the bicycle industry up to 2023, complemented by qualitative interviews with industry executives and industry-relevant financial investors. The key result: “Based on our findings, we forecast a gradual recovery with significant upside in the medium to long term, with 2026 and 2027 marking pivotal years for increased M&A activity and investment opportunities.”

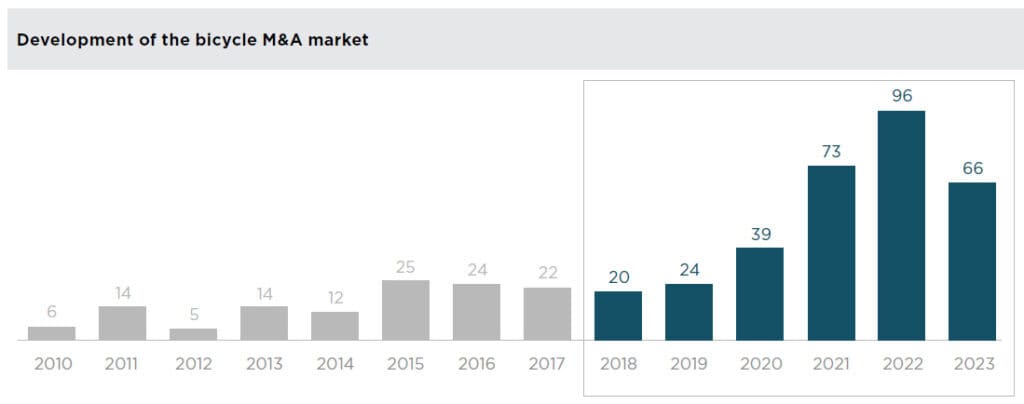

The analysis reveals an interesting development: until 2018, the two-wheeler sector was characterised by few M&A deals. The reason is that financial investors had only limited interest in the industry, as the bike market was often viewed as relatively niche, with modest growth prospects compared to other sectors. It was also highly fragmented and commoditised, “with numerous small and medium-sized companies crowding the market and fighting against one other – leading to relatively low profit margins and seemingly limited potential for future profitable growth,” the report notes.

Bicycle industry investment activity skyrocketed during the pandemic

However, with the onset of the pandemic, M&A activity skyrocketed. From 20 transactions in 2018 and 24 in 2019, the number surged to 39 in 2020. By 2021, it reached 73, and finally, 96 transactions were recorded in 2022. Key transactions included GBL and Canyon, Naxicap Partners and Stromer, and Ardian and YT Industries, as well as Pon’s acquisition of Dorel Sports.

This rapid surge in interest and M&A activity was primarily fuelled by factors such as positive macroeconomic conditions and the pandemic-induced bike market boom. “Financial investors also sat up and started to show an interest in bike brands due to favourable market conditions, the high demand for bikes, and the increased profits brought about by the supply and demand mismatch,” states the study, which describes this period as the maturing of the bike industry.

In 2023, the number of transactions dropped to 66 – confirming the ongoing economic downturn in the bicycle industry, which the Houlihan Lokey and Kearney study describes as a “downhill battle after climbing an unprecedented peak.” The research report notes: “As the world started to recover from the effects of the pandemic, M&A activity in the bike market began to falter. Conditions remained favourable during the first half of 2022, as evidenced by KKR’s acquisition of Accell Group, and 162 deals were completed over the 2022/23 period. However, the annual deal count started to decline, with 96 recorded in 2022 and 66 in 2023.”

Bicycle industry investments: Experts see signs of recovery

The positive news: investment experts are now seeing signs of recovery. As of 2024, the bicycle industry is gradually coming out of the pandemic’s shadow. “With inventory levels slowly starting to normalise, dealers and bike brands are expected to go into the 2025 season with a more balanced working capital position. Although still high, discount levels are expected to gradually balance out, lifting margins significantly over time. In fact, 68% of bike executives have positive profitability expectations in the medium term, citing healthy inventory levels and industry consolidation as key drivers for a return to healthy profitability levels,” was one of the conclusions from the interviews with industry leaders.

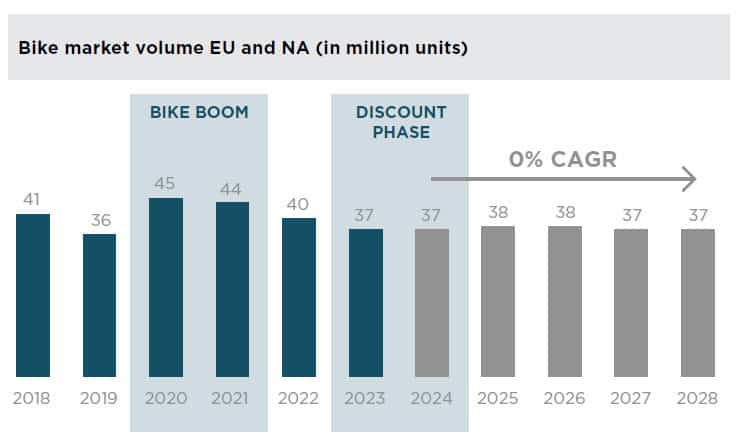

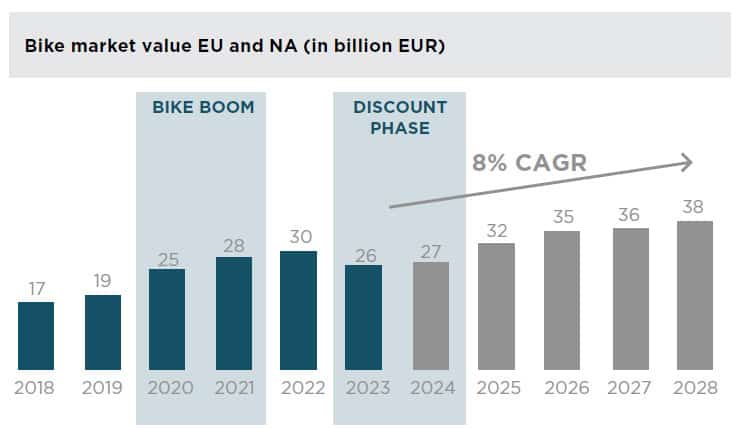

However, the recovery will be defined by value over volume. Although unit sales are anticipated to stay flat in Europe and North America, the report projects that the market value in Europe and North America could grow at an annual rate of 8%, reaching approximately €38 billion by 2028 due to the ongoing growth in e-bike sales.

“The vast majority of the industry executives we interviewed confirmed the growing relevance of this trend. 88% agreed that a compelling e-bike portfolio will be paramount to remain competitive going forward,” the analysts explain, who also cite additional factors for the continued recovery, such as more professionalisation across the industry enabling more consistent performance and the redesign of supply chains (e.g., through near-shoring), which should help structurally improve the risk level.

An encouraging message for the bicycle industry

The encouraging message: “Following a turbulent few years, the bike industry is on course to stabilise and gradually recover, with considerable potential in the medium to long term”, the analysts state, highlighting 2026 and 2027 as the pivotal years for a turnaround and a resurgence in M&A activities. “As the market recovers and bike firms position themselves to exploit emerging trends and technologies, we expect wise investors to start identifying prime targets now. In our view, bike manufacturers that have strong branding, a convincing e-bike portfolio, premium price positioning, and a clear distribution strategy should be top of the list.”

The full study is available on Houlihan Lokey’s website.