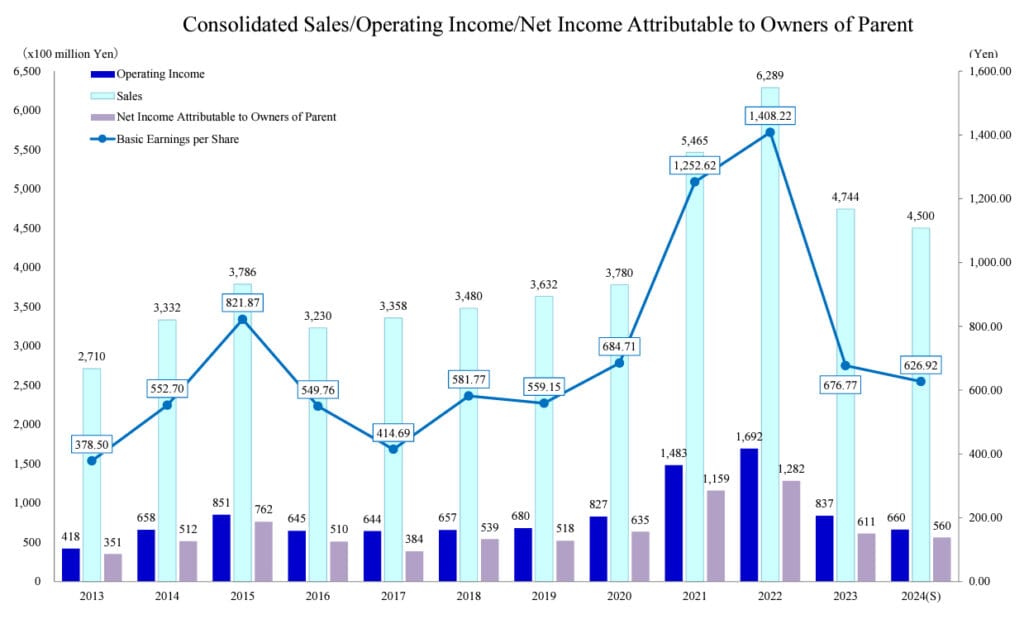

The quarterly report released yesterday by Shimano, Inc. shows a decline in net sales for the first nine months of 2024 compared to last year. However, compared to the previous year, Q3 showed an increase.

“During the first nine months of fiscal year 2024, geopolitical risks caused by the prolonged invasion of Ukraine and rising tensions in the Middle East, as well as stagnant Chinese economy, among other factors, exerted downward pressure on the economic climate. However, mainly on the back of subsided high inflation, the global economy emerged from the stagnant period and started to show signs of a pickup.” This is how Shimano’s Q3/2024 report, released on October 29, opens. As the world’s leading manufacturer of bicycle components, Shimano hints at an improving economic outlook. The positive news for the cycling industry is that this is also visible in Shimano’s sales figures.

Annual data heavily impacted by a weak first half

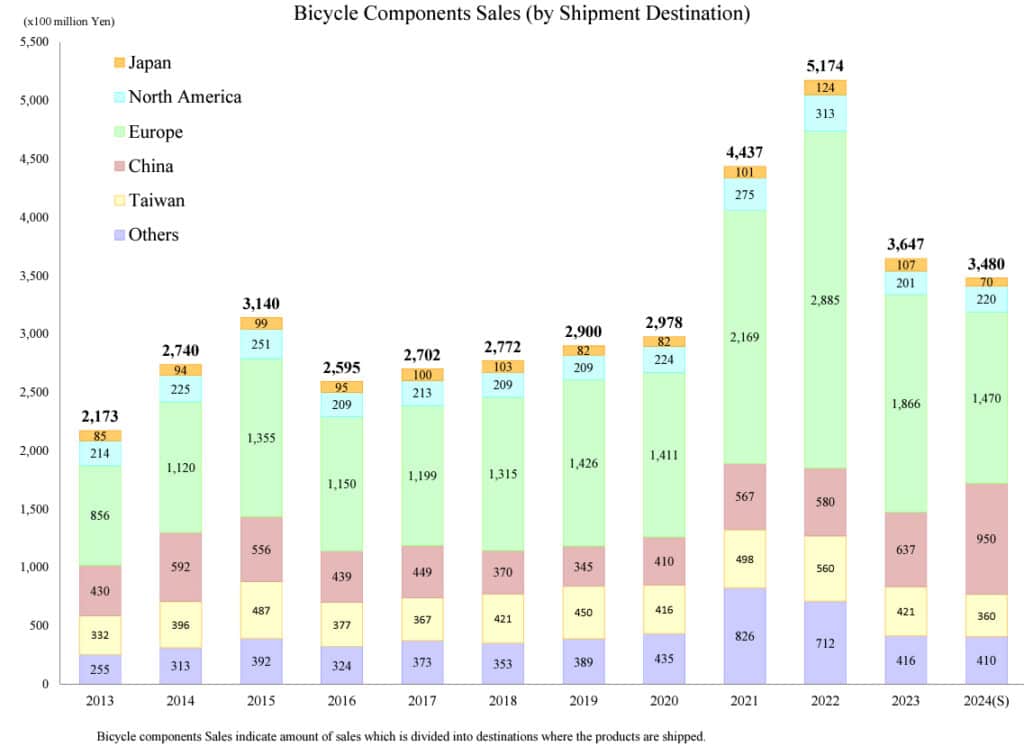

However, the year-on-year comparison of the first nine months reveals that this is merely a small positive signal. In the bicycle segment, Shimano’s net sales dropped by 12.3% from the same period last year to 253,861 million yen, with operating income down by 26.1% to 41,342 million yen. However, these nine-month figures are heavily impacted by the weak first half, during which net sales were a significant 20.7% below those of the same period last year, and operating income was even down by 42.2% compared to the previous year.

Shimano’s Q3/2024 data shows that the slight positive signals recently observed at industry events like the Taichung Bike Week are now also reflected in the figures. Extrapolating six-month results from the nine-month figures indicates that third-quarter sales reached 117,992 million yen, compared to 112,014 million yen in 2023, resulting in a quarterly gain of 5.3%.

A modest step into the right direction

The report acknowledged this modest step forward: “While the strong interest in bicycles continued as a long-term trend, retail inventories at retailers started to show signs of progress. However, market inventories of completed bicycles remained high.” Current revenue drivers are primarily the entry-level road group 105 and the gravel group GRX, as highlighted in the report: “Under these market conditions, the Shimano Group received a favorable reception for its products, including SHIMANO 105, a component for road bikes, and a gravel-specific component SHIMANO GRX.”

The latest Shimano report thus also indirectly confirms the positive development in inventory levels. During Taichung Bike Week, The Show Daily learned that the situation has recently improved for several major players, including Giant Group, Merida, KMC, and Shimano.

The full Shimano Q3/2024 data are available here.