An analysis by the capital and investment group CL Securities Taiwan examined the company reports of Giant, KMC, Merida, and Shimano – and identified positive trends.

One-on-one conversations, panel discussions, and more – this year’s Taichung Bike Week offered numerous opportunities to gain insights into the current state of the bicycle industry. One such opportunity was a presentation by Investment Analyst Shu-Yu Lin from the capital and investment group CL Securities Taiwan, as part of the Venture On Forum on the second day of the show. Lin presented findings from the “Taiwan Bikes” report, which analyzed corporate reports of publicly listed bicycle companies.

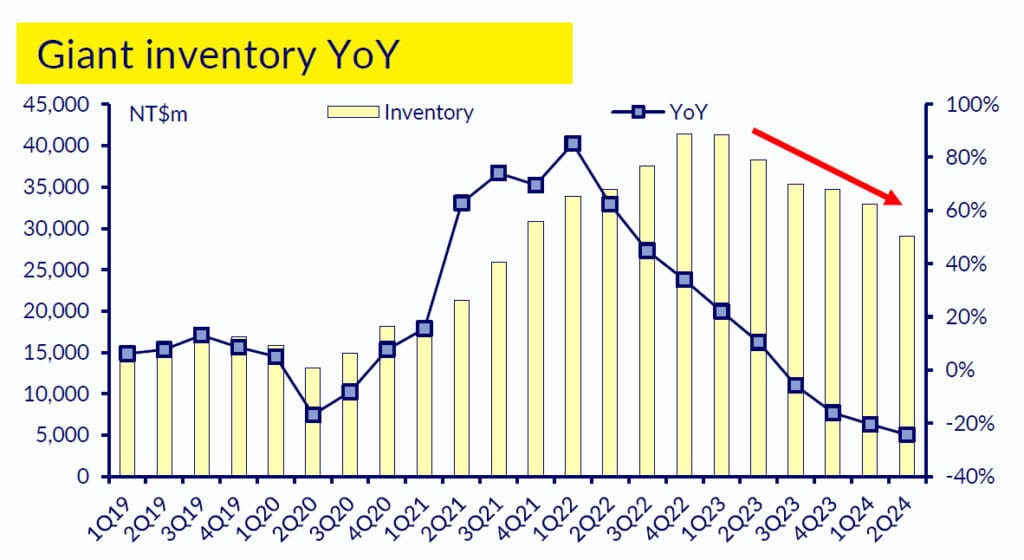

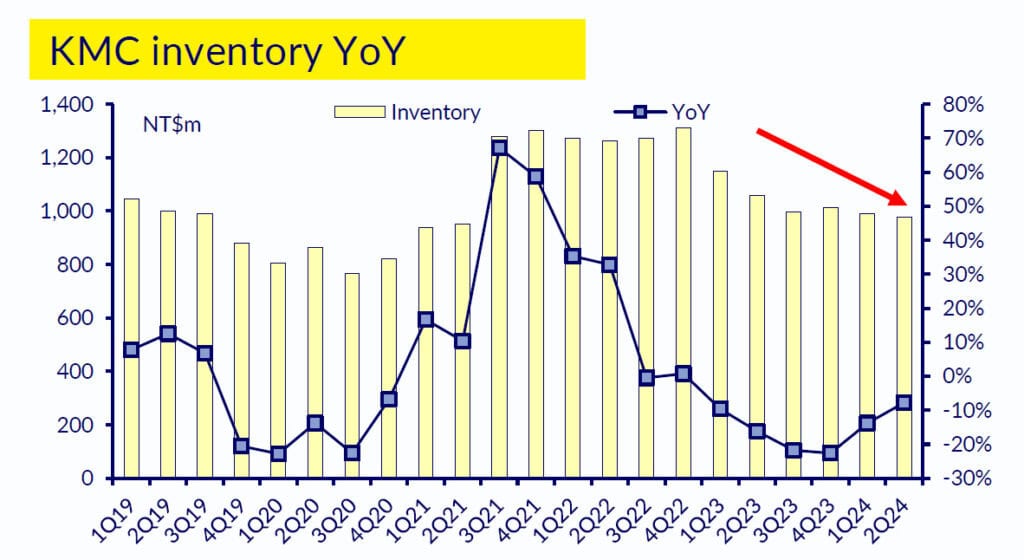

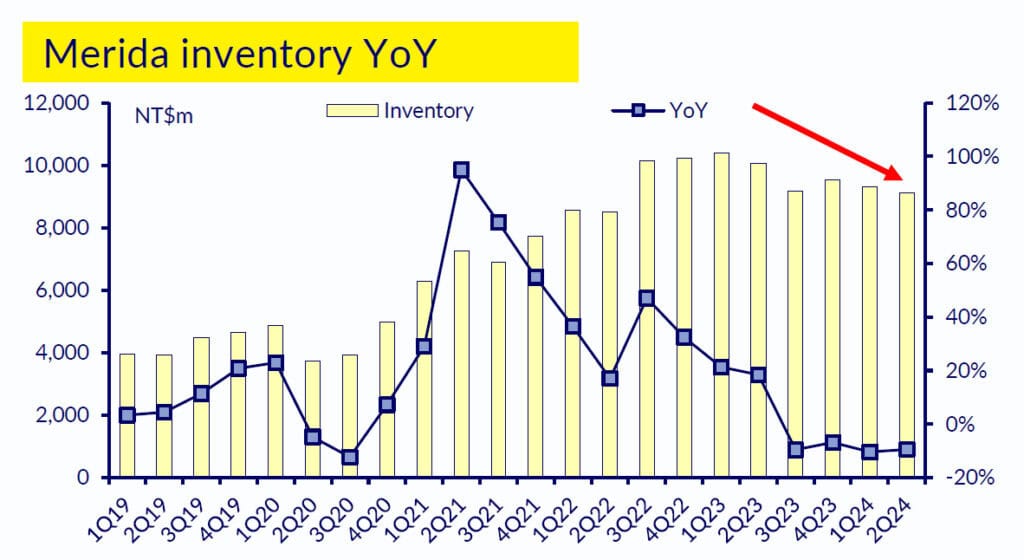

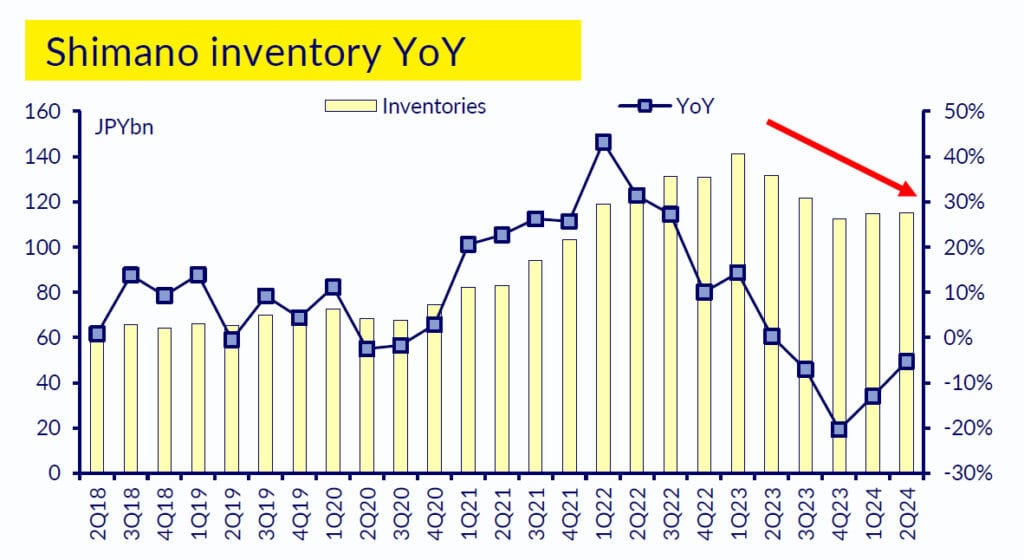

Inventory levels have passed their peak

According to the analysis, Giant, Merida, KMC, and Shimano all report decreasing stock levels. For all four companies, the peak was reached around the turn of the year 2022/23, and inventory levels have been steadily declining since. However, there are significant differences among the companies: KMC has already returned to stock levels similar to those before the pandemic peak, while this is not the case for the others. The graphs show overstock levels of approximately 20% for Shimano, 40% for Giant, and 45% for Merida (see graphs provided by CLST).

One driving factor behind this development is, according to the analysis, the increasing sales volume in China. Although export values are still below pre-pandemic levels, exports have been rising again since the turn of the year 2022/23.

Recovering stock levels are good news for the bicycle industry

Recovering inventories at these companies is good news for the global bicycle industry. This aligns with the increasing reports suggesting that the worst phase of the economic downturn, which began in the summer of 2022, has been overcome. Recently, the Accell Group also reported that their inventories are expected to largely normalize by the end of the year.

As part of the upcoming Taipei Cycle Show, The Show Daily will take a closer look at the corporate reports of listed companies and the developments highlighted in them.